Ratni Mohamed Raouf

University of Algeria 3 Ibrahim Sultan CheiboutFaculty of Economic Sciences, Business Sciences and Management Sciences

COVID-19 or what we know as Corona virus disease is probably the most trending topic since 2020 has started, it did spread fast and became the main problem for governments all around the world. This pandemic affected people’s lives knowing that the spread of the coronavirus will destroy economic growth and that the government actions may not be enough to stop the decline.

Potential economic collapse:

As the number of new cases continues to surge in most parts of the world, governments are working to slow the contagion and reach of the virus, these measures are important to save people lives but its is an unparalleled disaster for the global markets, the demand destruction reaching nearly every single sector will continue as the world’s largest consumption centers cascade unto national lockdowns and prohibit the movement of all nonessential activity.

Effects of Coronavirus pandemic (COVID‐19) on Civil Aviation:

Coronavirus outbreak directly impacts air traffic and revenues of aviation industry because of flights cancellations, aircraft groundings and travel ban.

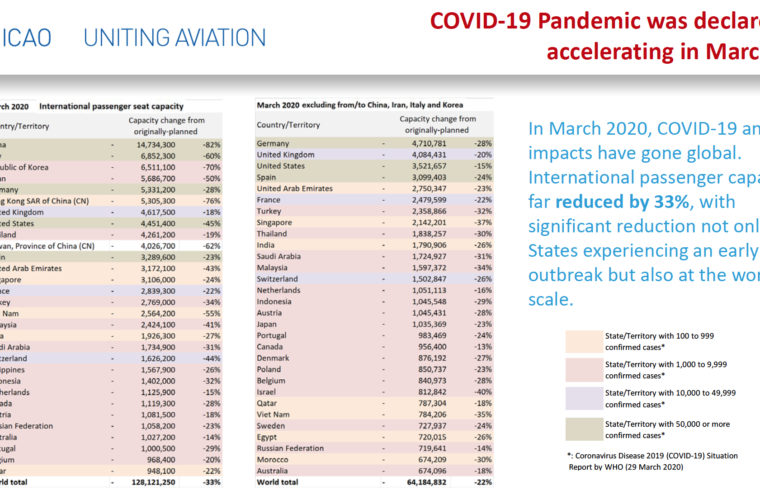

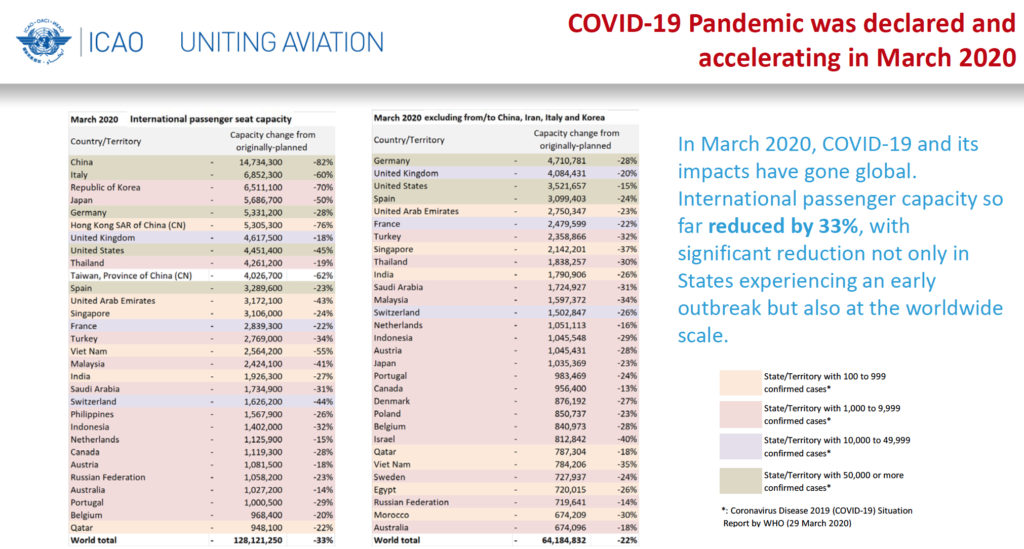

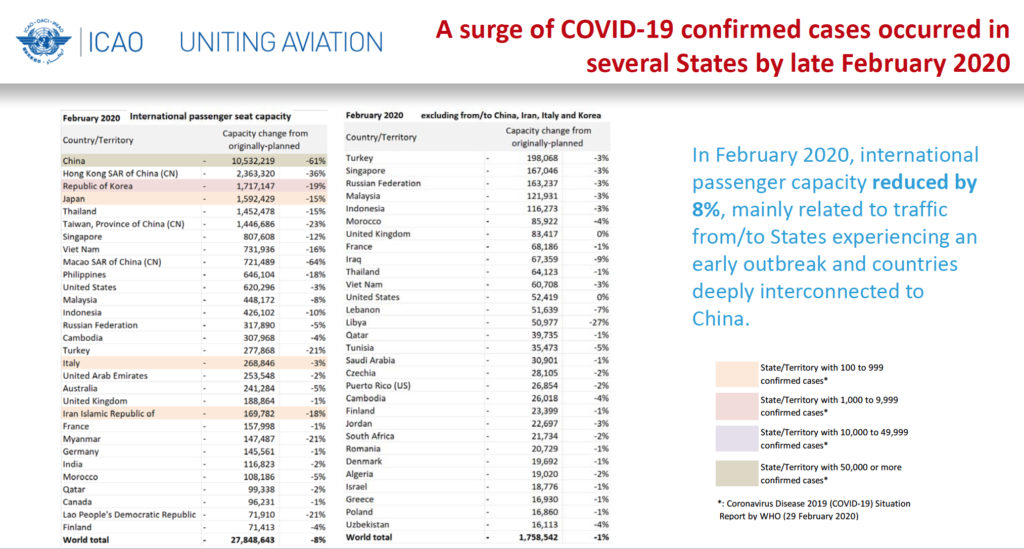

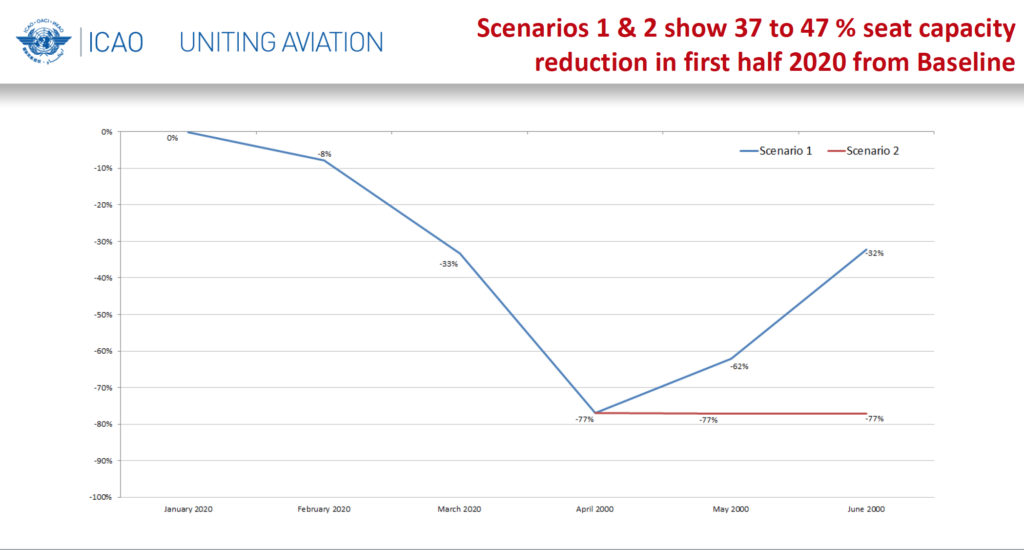

The impact on scheduled international passenger traffic during first half 2020, compared to Baseline (originally-planned) according to the International Civil Aviation Organization (ICAO) is:

Overall reduction of 37% to 47% of seats offered by airlines and 401 to 528 million passengers which will lead to around 88 to 116 billion USD potential loss.

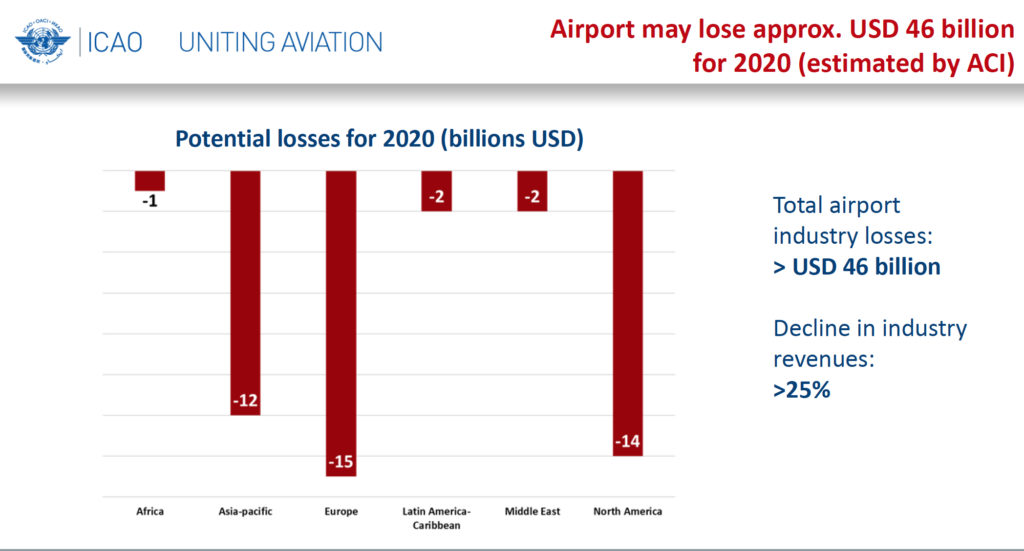

Airports may lose around 46 billion USD according to the Airports Council International (ACI).

These preliminary estimates indicate that many airlines worldwide are facing the threat of bankruptcy in coming months, if these declining trends continue.

A perfect storm of the COVID-19 spread and an oil shock:

The chaos that started in Asia slammed the global stock market after a crash in the oil price, global oil prices nosedived around 30% on March, 9th after Saudi Arabia started a price war by slashing crude oil prices for April and announcing an increase to its output.

Trading on Wall Street was frozen within minutes of the market opening as the system to buy and sell shares failed to keep pace with events.

The Dow Jones closed down by more than 2,000 points for the first time ever, a decline of 7.8%.

The S&P 500 finished the week’s first trading session down about 7.6% its worst day since the 2008 global financial crises.

The Nasdaq dropped 7.2% to 7950.68 points.

Markets in the UK, Germany, France and Spain among others, all posted huge losses as well, if the market disruptions continue and the Coronavirus fear amplify we will witness recessions in many countries.

The oil price war:

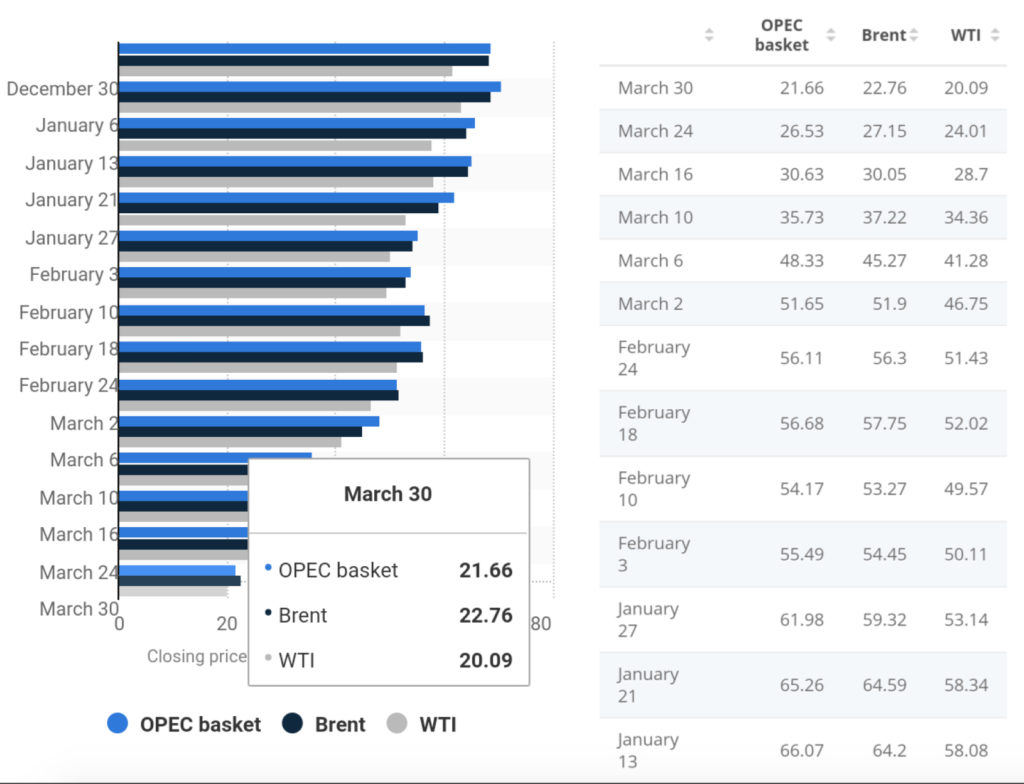

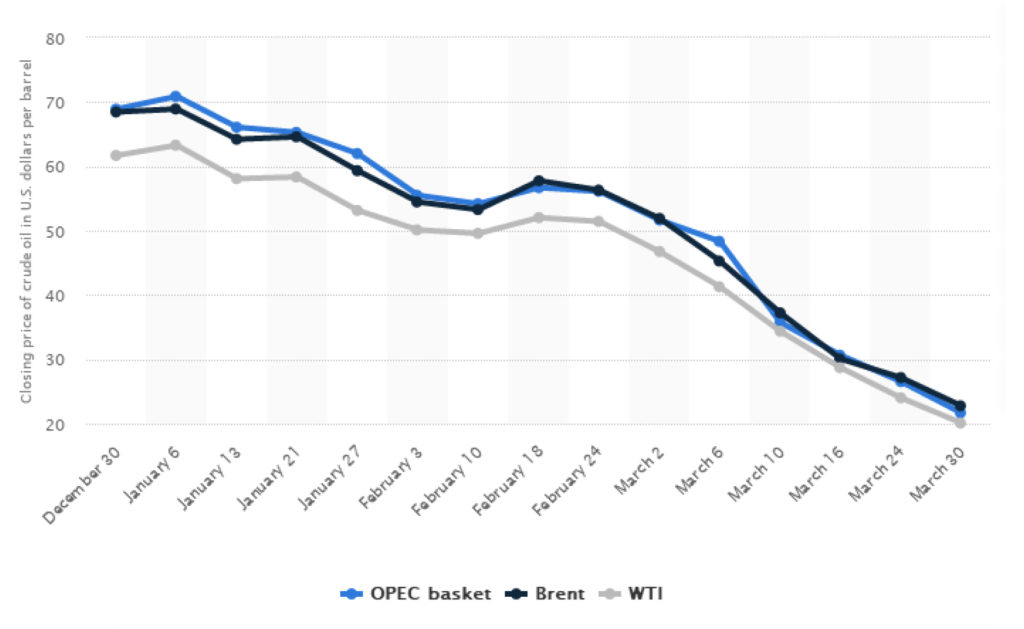

An oil price war has started between Saudi Arabia and Russia and now oil prices dropped to a low not seen in 20 years.

US West Texas Intermediate crude (WTI) dropped at just over 20 USD a barrel a low not seen since February 2002.

Brent crude was down to 22.7 USD a barrel.

Opec Basket dropped to 21.66 a barrel.

The following Data is taken from statista.com:

Saudi Arabia announced that it will sharply increase its oil production after a 3 years deal collapsed this month between the Organization Of The Petroleum Exporting Countries (OPEC) and other producers, led by Russia.

Saudi Arabia has ordered its state-run oil company Aramco to supply some 12.3 million barrels a day from April.

Alarmed by the oil price war between the world’s top producers, US Secretary of State Mike Pompeo spoke with Saudi Arabia Crown Prince Mohammed bin Salman to press him to refrain from upping oil production. The State Department said Pompeo focused on the need to maintain stability in global energy markets according to the White House.

Also President Trump spoke over the phone with President Vladimir Putin and agreed on the importance of global energy markets regaining a degree of stability, this step is important knowing that the oil American industry is also a loser from the current price war according to Securing America’s Future Energy (SAFE).

Countries like Iraq, Angola and Nigeria (all OPEC producers) were in a “very, very difficult situation” and would require support from the rest of the world.

“They are facing major fiscal strains. Many of them will have difficulties to pay the salaries for the public sector, spending for health, for education, which in turn may provide social pressures in those countries.

In fact energy markets needs an agreement between Moscow and Riyadh in order to deepen oil output cuts and prop up prices to avoid another oil crush.

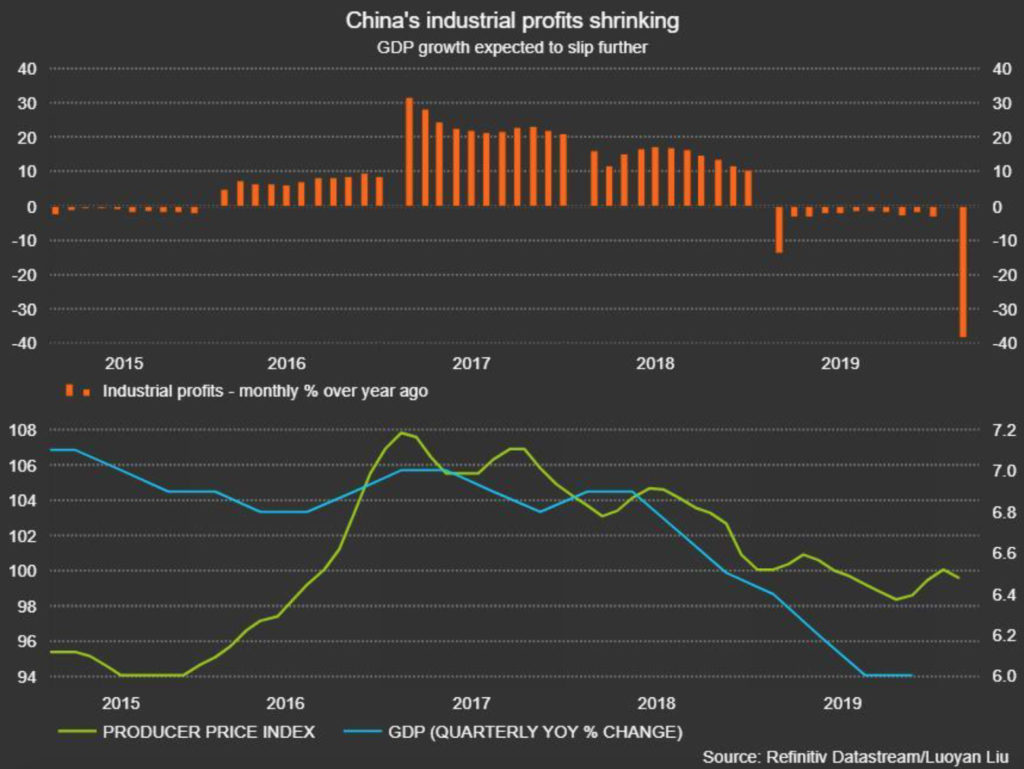

Economic damage in China:

China’s social isolation policies appear to have contained the Coronavirus at home, allowing work and travel to resume. But major economic damage may be yet to come.

With infections climbing exponentially in the United States, Europe and the others markets China exports to, and with supply China in disarray, China is getting neither the imported components it needs nor demand for its products.

Already Chinese factories January to February profits have hit their lowest in a decade and upcoming manufacturing surveys will very likely reveal more loss. And just like every other countries, job losses are mounting up, regardless of how many cheap loans are being offered to businesses. Expectations are now for the economy to contract this quarter but many economists reckon 2020 growth will be around 2% instead of 6%.

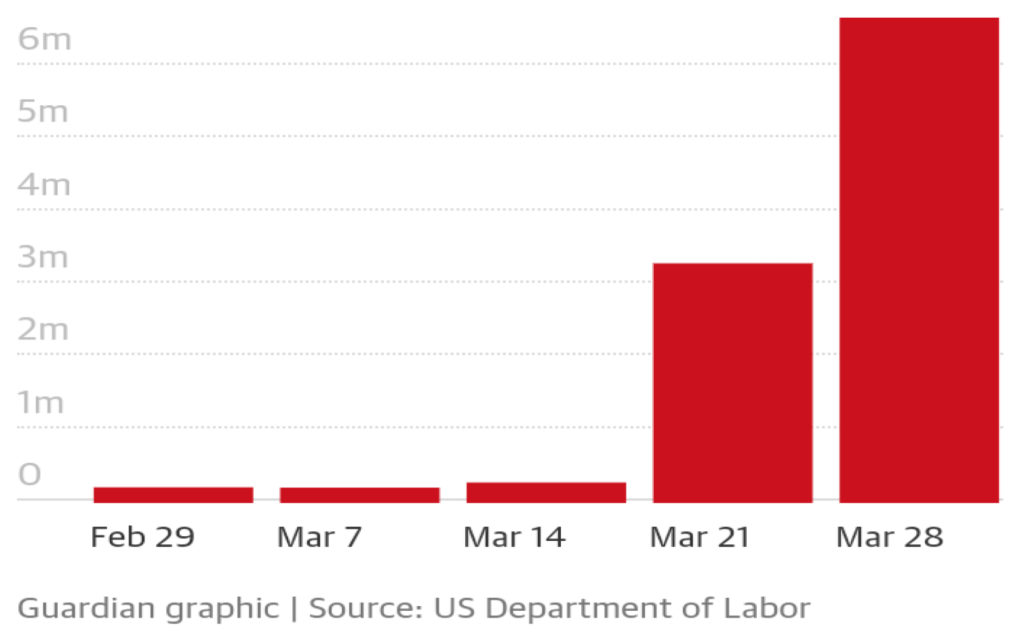

Economics expect the payroll data to show a loss of 293,000 jobs, the largest monthly drop since July 2009 and the number may increase. A significant overshoot of that the 2 trillion USD stimulus approved by Congress suddenly started to look inadequate.

European commission response to the economic damage in Europe:

In order to secure businesses and support jobs, secure essential food supplies. European countries are trying to use every single Euro wisely to reduce economic damage.

European commission on April 4th has published the following proposals:

Create a new EU solidarity instrument to help workers keep their income and help businesses stay afloat and retain staff. This will provide financial assistance up to €100 billion in EU loans and will be an EU-wide scheme to mitigate unemployment risks.

Adapt the Fund for European Aid to the Most Deprived to ensure that food deliveries can continue going to where they are needed, while making sure those delivering and those receiving stay safe.

Specific measures to support Europe’s fishermen and farmers who play an essential role keeping the food supply going and in sustaining the local communities.

The Commission is proposing to allow every available euro of European Structural and Investment Funds to be used on the response to the Coronavirus.

Redirect every available euro from this year’s EU budget to help save lives through a new EU solidarity instrument. This will ensure that €3billion in EU is directed to supporting Member States to manage the public health crisis.

List of references

Official reports :

- International Civil Aviation Organization (ICAO), March 31st.

- European Commission, Brussels, March 13th, COM (2020) 112 final, Coordinated economic response to the COVID-19 Outbreak.

- European Commission, Brussels, April 2nd, COM (2020) 143 final, Using every available euro in every way possible to protect lives and livelihoods.

- World Health Organization (WHO), Coronavirus disease 2019 (COVID-19) Situation Report 70, Mach 30th.

Websites:

- www.theguardian.com

- www.statista.com

- www.oilandgaz360.com

- www.weforum.org